Imagine a world where financial decisions are made in a fraction of a second, fraud is greatly reduced, and people can take informed risks. This is the future as AI becomes more and more integrated into financial services.

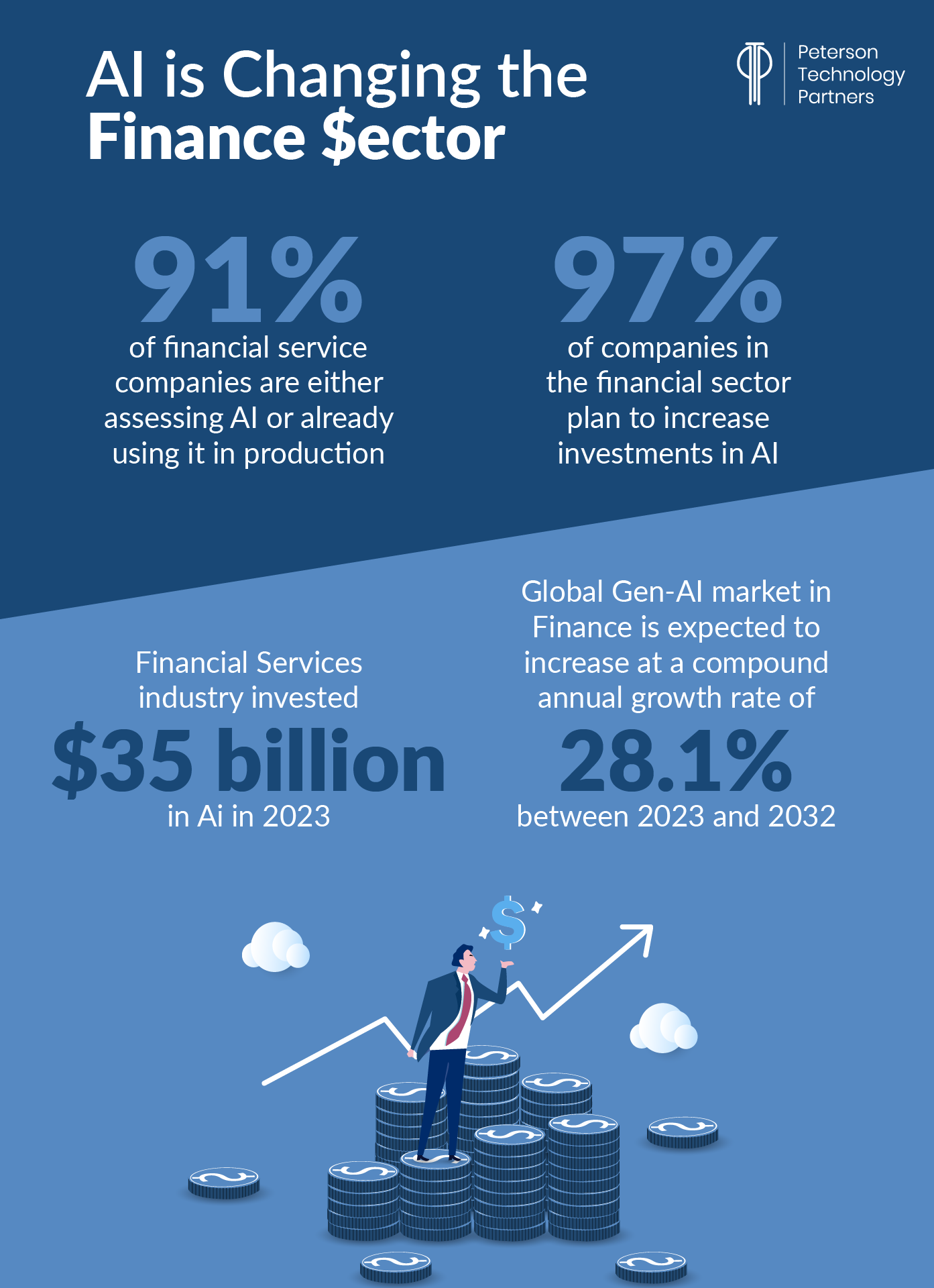

It may sound surprising, but the finance sector is at the forefront when it comes to AI integration, exhibiting one of the highest adoption rates across industries. In 2023 the financial services industry invested an estimated $35 billion dollars in AI. Capital One leads banks in AI adoption followed by JPMorgan Chase, and the Royal Bank of Canada.

In 2023, over 40% of financial institutions used Gen-AI. In addition, the global Gen-AI market in finance is expected to increase at a compound annual growth rate of 28.1% between 2023 and 2032. This also means that it will go from a $1.09 billion dollar market in 2023 to a $9.48 billion dollar market in 2032.

Mckinsey Global Institute estimates that the impact on the banking sector could be massive with the total potential added value ranging from $200 to $340 billion dollars. This added value is staggering.

While there are many benefits of integrating AI into the finance sector, there are also risks to be aware of. We will also explore some of the most efficient ways to integrate AI into financial services. These financial services impact us all, and even companies with a finance department will soon contact AI if they haven’t already.

What are the Benefits?

Speeds up Tasks

One of the most obvious benefits of integrating AI into financial services is that it speeds up tasks. Like other industries AI is largely augmenting the tasks performed by employees whether it be back-office automation, data aggregation and visualization, and fraud prevention. A few areas where AI can be a great help are in loan processing, customer onboarding, and check deposit processes since they are not very well integrated by the majority of the banking systems. It may take a long time to receive a mortgage loan with all of the steps involved, but the time can be greatly reduced if they can adopt new age cloud solutions faster.

Fraud Prevention

In addition, another area that AI can benefit financial institutions is in fraud prevention. AI can help combat fraudulent activities such as money laundering for example. This will allow financial institutions to validate transactions, bolster security, and respond to threats. Another great example is how companies are now using AI to monitor a large number of credit card and e-payment transactions daily, detect changes in our purchase behavior, and provide a more streamlined process to deal with any fraudulent activities to protect us. In the future, AI will be used to help improve cash flow accuracy. This will not only help prevent fraud, but it is also crucial for effective cash flow management because it impacts decisions related to investing, financing, and operating activities.

Better Customer Service

Furthermore, customer service is another area that AI can improve with its integration. AI can provide immediate and accurate responses to client inquiries. Combining human problem-solving skills and AI data retrieval will result in better service. When AI analyzes a variety of customer-related data it will lead to better tailored products and services. Banks are already using AI and machine learning to predict consumer behavior and understand their purchase preference. This could lead to better matches between customers and financial institutions which will in turn increase economic efficiency.

How Can AI Tools benefit Financial Services:

- Speeds up tasks like back-office automation

- Helps combat fraudulent activities like money laundering

- Helps monitor transactions

- Helps detect changes in purchase behavior

- Will help improve cash flow accuracy

- Improve customer service by providing immediate and accurate responses to client inquiries

What are the Risks?

Data Quality Issues

Although it is exciting to see how AI benefits financial institutions, there are still risks that need to be addressed. For example, AI models are trained, meaning they are more likely to learn and sustain biases or errors inherent in the data they have been trained on. This means they may be prone to data quality issues because sometimes data collection methods require manual effort which opens the door for human error and biases during decision making.

Accuracy of AI Predications and Root Cause of Errors

Furthermore, AI’s algorithmic biases and its vulnerability to data quality issues pose risks to the accuracy of AI predictions. If financial institutions base their decisions on unchecked, faulty AI predictions, it could lead to significant economic losses or even disorderly market movements. Also, as AI gets more and more complex it will become increasingly difficult to identify the root cause of errors or explain any decision based on AI.

Discriminatory Customer Treatment and Data leakages

Moreover, AI’s algorithmic biases may lead to discriminatory customer treatment which could not only be difficult to identify but also to monitor. The possibility of a data leakage is another concern especially in the case of AI trained on customer-specific data. This could expose financial institutions to reputational or legal risk.

Third Party Reliance

Staying on the topic of privacy, the base architecture for AI models may need to be acquired externally. This will increase third party reliance and could also raise data privacy concerns if the models provided by third parties are fine-tuned using confidential internal data such as financial statements or internal records. Privacy should always be a primary concern for financial institutions and especially now with AI.

[For more information on the benefits and vulnerabilities of AI, check out this PTP Report]

What is the Best Way to Implement AI?

Aleph Alpha is an R&D company (supported by SAP) that researches, develops, and operationalizes large-scale AI models for public and private sector partners. They offer advice to banks and financial institutions on how to get the best value from AI.

Christian Brüseke, who is the Global head of financial service at Aleph Alpha, explains that financial institutions must first begin with understanding the proper function of various elements such as machine learning, predictive AI, and generative AI within the broader context of AI. This will help breakdown the complexity of AI and make it more digestible to understand.

[Also, PTP is another good source to learn about AI and how companies can integrate it]

Banks should take a good look at their business priorities in all areas from product development and customer support to operational processes, risk, and compliance. This will help them determine where the opportunities are to implement AI. Aleph Alpha even founded a joint venture with PwC to better drive the dissemination of AI and use of AI solutions.

Typically, in the business world, developing a use case is the first step in adopting new practices in the financial environment. However, companies should prioritize business objectives first, then understand compliance requirements, explore the best tools and solutions to meet their needs, and finally, create a use case. This will ease the integration of AI into financial services.

Conclusion

With all the advancements in AI, it should be of no surprise to see the finance sector try their best to integrate it into their way of business. AI speeds up tasks and increases efficiency, can help with fraud prevention, and improve customer service by combining human problem-solving skills and AI data retrieval.

Furthermore, everything has risks and AI is no different. We are still at a stage where we are just beginning to understand AI as it becomes more widely used. Some of the risks AI poses for financial institutions could cause major problems and disruptions, such as: biases or errors that badly influence decision making and are negatively influencing the accuracy of AI predictions and customer treatment.

Finally, financial institutions should remember that help is out there for them on how to best integrate AI into their business practices. Companies like Aleph Alpha are out there that provide banks and financial institutions with advice on how to get the best value from AI. It is also recommended that companies reorient how they adopt new practices to ease AI integration into their company.

References

Artificial intelligence (AI) in finance – statistics & facts, Statista

Artificial Intelligence Opens Up The World Of Financial Services, Forbes

How AI and quantum technologies are transforming the financial industry, The World Economic Forum

Scaling Gen AI in banking: Choosing the Best Operating Model, Mckinsey & Company

The Rise of Artificial Intelligence: Benefits and Risks for Financial Stability, European Central Bank

You Can’t Spell Finance Without AI, Forbes

5 Ways to Hone Your Financial Service Superpowers with GenAI, Forbes