PTP Key Takeaways:

- AI in banking and finance is on the rise as business is booming for many key players.

- JPMorgan Chase is leading the way with employee AI training and domain-specific financial AI models.

- AIG’s modernization in insurance is flourishing by leveraging AI for underwriting optimization.

- Morgan Stanley’s wide adoption of GPT-powered tools attempts to improve AI for customer service in banking.

- Goldman Sachs has deployed some of the most extensive AI coding automation agents in finance.

- Citigroup’s transformation uses AI for compliance; Capital One’s includes extensive academic partnerships and multi-agent prototypes.

Big banks enjoyed record earnings in October, ending a nearly three-year run of stagnation on Wall Street. Goldman Sachs, JPMorgan, Morgan Stanley, and Citi all saw impressive gains, and while there are numerous factors driving the turnaround (including rate cuts, low credit losses, deregulation enthusiasm) and questions about its longevity, AI is a substantial part of the conversation.

For this reason, we’re focusing on the financial services this week in our latest edition of our AI Works series, looking at AI use across industries.

You can check out our prior coverage of AI in healthcare and AI automation in recruiting, a topic that’s also been the focus of our founder and CEO in his newsletter (most recently considering the challenges facing recruiters as AI use by job-seekers scales up).

AI in the Financial Services in Action

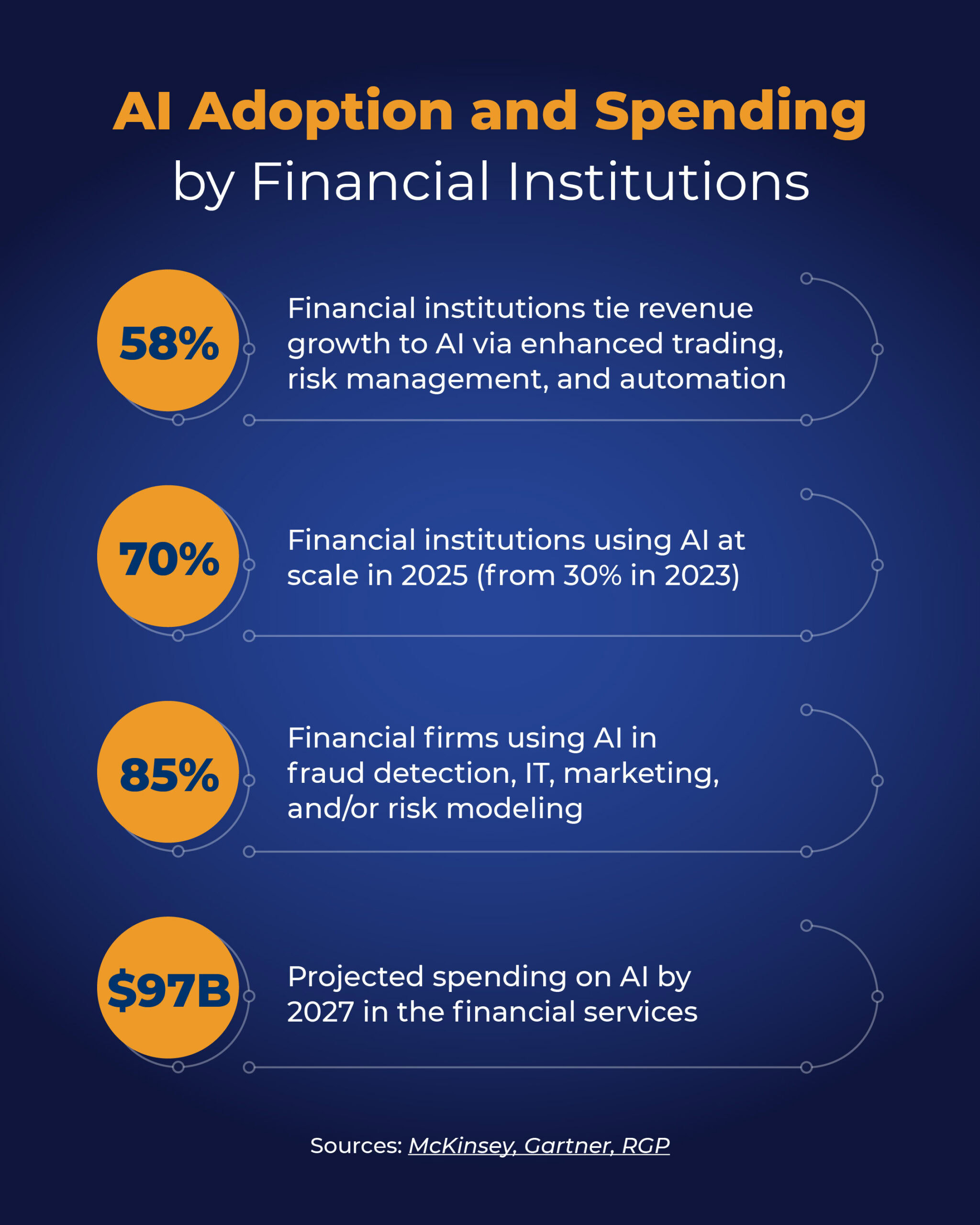

Financial firms have long been among the leaders in AI adoption, working to pilot AI and ML solutions well before the GenAI boom sounded with ChatGPT. And since that time, AI use within the sector has only grown and grown fast.

For an industry where profitability for the high performers hasn’t changed much in forty years, Hennessy Funds portfolio manager David Ellison told Yahoo Finance that AI is viewed as one thing that can finally move this needle, enabling companies to “break out of this historical range of profitability.”

In his November 11 speech at the Singapore Fintech Festival, Federal Reserve Governor Michael Barr agreed, discussing the rapid adoption of AI in the financial services.

He noted that:

- AI is currently listed as a desired skill in more job posts in the financial sector than in almost all other fields (behind only the information sector, and not by far), as firms crave a technological edge.

- The most common uses of AI he sees are for boosting operational efficiency, such as for customer-facing functions, text analysis, classification, and internal firm search.

- But there are also big investments happening to bring AI into core functions, or data-driven finance-specific tasks, like fraud detection, supporting credit decisions, and trading.

- He believes these innovations will lead to significant organizational change in the sector, but there are real challenges still being overcome, and if machine learning (ML) is any indication, it will take time to play out.

- In the meantime, larger financial organizations are looking to leverage services from companies built around AI to span these gaps.

- Risk management remains one of the biggest challenges, given the regulation around finance and its required precision.

A report by McKinsey released in November cites that 65% of CFOs are increasing their AI budget in 2025, with the most value they see coming from three key areas:

- Predictive analytics and forecasting

- Scrutinizing terms and invoices to improve back-office efficiency

- Optimizing their spending

As in other industries, many splashy pilots have failed to deliver value, even as JPMorgan Chase CEO Jamie Dimon says his own company’s AI spend (around $2 billion a year) has already paid for itself.

What’s still holding companies back?

The issues are the same as ever: data preparation, transforming at too great a scale all at once, lacking a sufficiently clear AI roadmap, failing at change management, and implementing inconsistently and without addressing workflows.

Key Examples of AI Implementations in Banking and Finance

Given their long commitment to AI, the amount they spend, and their aggressive training for staff, JPMorgan Chase is a good place to start in our look at examples of ongoing implementations.

JPMorgan Chase and Domain-Specific Financial AI Models

In an interview with Bloomberg TV in October, CEO Jamie Dimon noted that his company has been working with AI since 2012 and today they have 2,000 people working specifically on it.

Today, “it affects everything,” he said, from risk and fraud to idea generation, marketing, and customer service.

And while many of the benefits have been hard to quantify, they know they’re getting at least $2 billion back in cost savings, and that this is just “the tip of the iceberg.”

The company’s earlier AI innovations included COiN for contract intelligence (a machine learning engine that reads loan agreements and commercial contracts at scale) and LOXM (for optimizing trade execution in equities).

In the GenAI era, they’re making wide use of their own propriety platform, called LLM Suite. Using models from OpenAI and Anthropic, it is being incrementally updated to draw in more data and perform more of the tasks currently done by their wide array of software applications.

Tuned on their internal policies, templates, and research, it also allows for strict access control and more effective logging, bringing together tasks once separated by areas of the business.

“I think people shouldn’t put their head in the sand,” Dimon said of the AI impact. “It is going to affect jobs.”

While there will be jobs that it will eliminate, he added “you’re better off being way ahead of the curve and retraining people.”

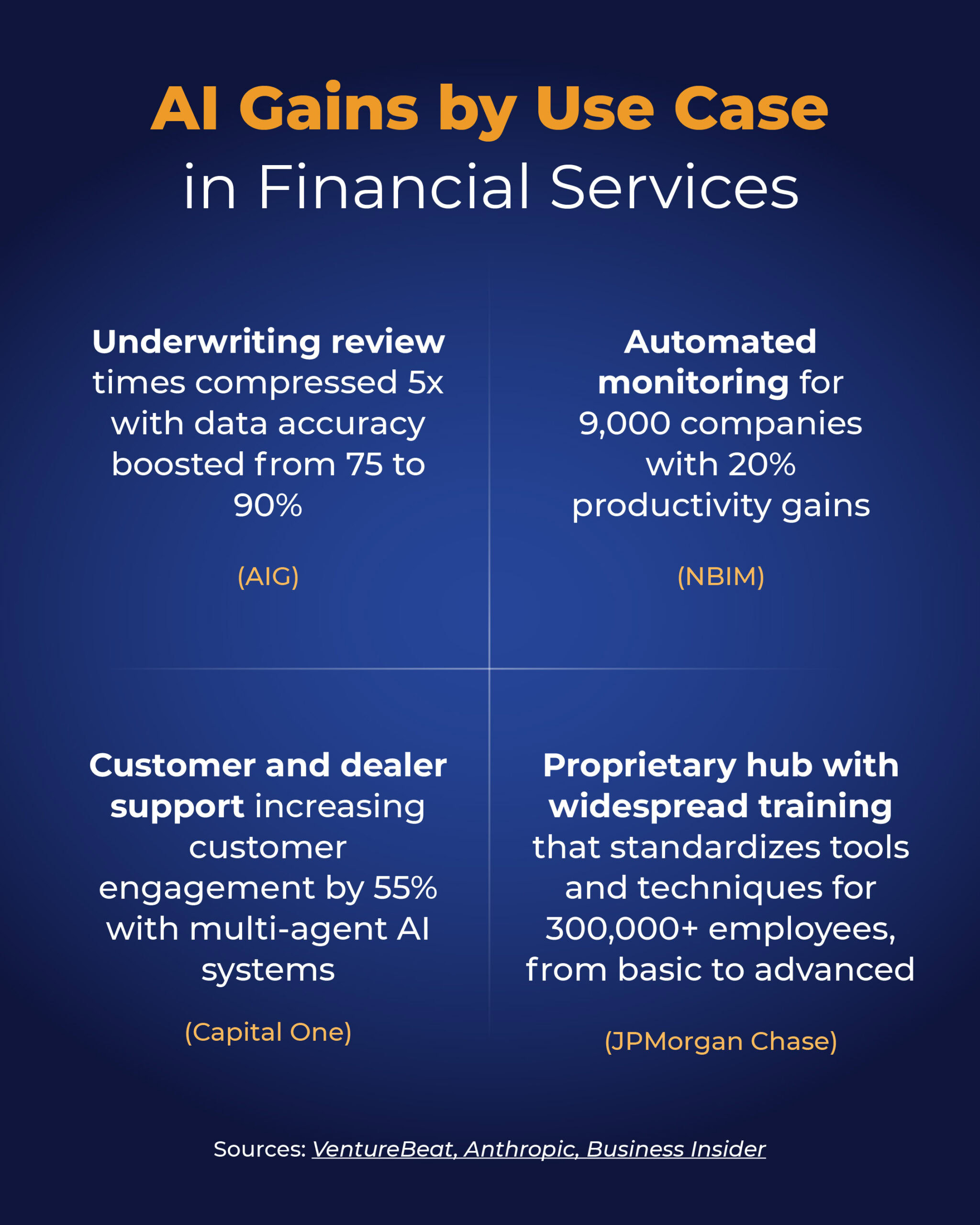

And Chief Analytics Officer Derek Waldron told McKinsey that they’re well underway in this goal, with the aim of getting 300,000 employees across sectors not just using AI but using it effectively.

This includes leading with managers, and starting with basic knowledge (“AI Made Easy”) focused on what they can and can’t do.

As their modules ramp up, it includes training on changing a system’s persona from maker to checker, using two LLMs debating to get better results, as well as establishing effective prompt libraries and team initiatives like intra-team training and sharing a prompt of the week.

While agentic solutions are just starting to come online, the company’s Chief Data and Analytics Officer Teresa Heitsenrether said at a conference in October that she believes people will soon be managing large numbers of digital agents, giving early-career staff management responsibilities sooner than normal.

Their data scientists, meanwhile, are no longer building standard models. Instead, they’re tasked with evaluating and improving models provided by third parties, using their talents instead for “designing, evaluating, and optimizing systems.”

AIG: Transformative AI for Underwriting Optimization and More

In insurance, AIG has been undergoing its own technological revolution since the early 2020s, partnering with firms like Anthropic, AWS, and Palantir to make effective use of AI.

Shifting from highly manual processes in underwriting (submissions coming in a variety of forms, with humans picking out data, checking to tables, and reconciling), these innovations are having success at automating much of this process (structuring the data, pulling the data, and making comparisons).

It’s that classic AI case that’s being made across industries, put to action: AI takes on the grunt work far more efficiently, while the humans apply their judgment to verify and complete.

This has both greatly accelerated their review timelines and increased accuracy—at the same time. It has also meant rethinking their workflows entirely, rather than just adopting AI tools along the way.

AIG is also utilizing AI for claims intake and triage, and in compliance for reconciling policies with variable regulations.

Morgan Stanley: Improving AI for Personalized Customer Service in Banking

Like many of the companies in this article, Morgan Stanley has long been invested in AI, rolling out products like their NBA (Next Best Action) back in 2018.

For GenAI they partnered early on with OpenAI, using GPT-4 for a custom-trained tool that helps advisors handle proprietary knowledge more efficiently.

Overall, they make wide use of AI across the business, most notably for wealth management, productivity, and workflow automation.

The Head of Firmwide AI at Morgan Stanley Jeff McMillan says of AI:

“This technology makes you as smart as the smartest person in the organization. Each client is different, and AI helps us cater to each client’s unique needs.”

Claiming 98% adoption for wealth management, AI has dramatically increased access to needed documents, reduced search time, and accelerated document retrieval.

They’ve also implemented AI in areas like predictive analytics, content generation, and compliance automation.

Goldman Sachs: Powering Coding AI Automation in Finance

In discussing their Q3 fiscal results, Goldman Sachs made reference to their own considerable AI initiatives. In 2025 they’ve rolled out what they’re calling “One Goldman Sachs 3.0,” a multi-year, centralized operating model with the goal of re-imagining their processes with AI.

CEO David Solomon told CNBC that he’s “super excited about the technology” and the development being done to enable more AI impact on enterprises.

And while he’s “still very optimistic” he also acknowledged that “It’s hard to get the stuff deployed.”

Ultimately, he stands by the view that the long-term productivity gains are going to be truly “extraordinary.”

In their own use, Goldman Sachs made news this summer by partnering with the startup Cognition to deploy hundreds of autonomous Devin coding agents to work alongside their 12,000 human developers.

And they expect this investment to bring productivity boosts of three-to-four times what they were getting from their prior tools.

[Our CEO included this among his profile of real agentic AI implementations in action in early October—check the article out for more on this.]

Goldman Sachs has also implemented their GS AI Assistant, launched firmwide in June. It helps with tasks like summarizing documents, drafting initial content, and doing data analysis.

Citigroup: Agent Assist and AI for Improved Compliance in Finance

Citigroup’s CEO Jane Fraser has made a strong pivot towards AI, with the aim of using the technology to modernize and learn from compliance issues which cost them more than $135 million in regulatory penalties in 2024.

Fraser has been outspoken about the prior state of their data infrastructure, saying that they fell behind in areas like regulatory reporting.

They’ve also deployed their own chatbot assistants that have led to productivity gains, and developer tools that provide automated features like code reviews, all as part of an overhaul that’s retired more than two thousand applications over the past three years.

And like many of the firms profiled here, they’ve partnered with a major AI provider in Google, making use of Google Cloud and its Vertex AI platform.

Citigroup has an emphasis on guardrails, strong ethical guidelines, data control, and oversight to give them more control and help them learn from past mistakes.

Capital One: Partnerships, Multi-Agents, and AI in Fraud Detection

Capital One has long been at the forefront of AI, termed “AI first” as far back as the summer of 2019. As a result, they’ve long understood the importance of abundant, well-managed data for getting good results from AI.

In support of safety and responsible AI use as well as ongoing research, they’ve also worked to establish partnerships like one announced this summer with the National Science Foundation (their first with the government). This joins a number of existing arrangements with colleges, like Columbia University, the University of Illinois Urbana-Champaign, and the University of Southern California.

And like others, they also maintain partnerships with major AI firms (using the Nvidia inference stack), and have deployed AI service tools to aid customers, AI models to customize user experience, and an ML-driven, proprietary real-time financial monitoring fraud detection system.

On the cutting edge, their new multi-agent system was deployed to improve their auto business. Called Chat Concierge, it works with both customers and dealers, providing 24/7 AI assistance and yielding higher data quality and significantly improved customer engagement (improved 55%). It also helps dealers recognize serious leads more quickly and effectively.

SVP of AI Foundations at Capital One Milind Naphade told VentureBeat of the project:

“We’d like to bring this capability to [more] of our customer-facing engagements. But we want to do it in a well-managed way. It’s a journey.”

Conclusion

Here we’ve focused on large financial institutions that have been out front and outspoken on AI. But there are also a number of significant startups in the space, like Rillet, providing AI-powered ERP finance tools to automate accounting tasks, and Rogo, whose products automate financial workflows with improved financial forecasting with AI.

And while we’ve looked at ongoing initiatives and AI successes here, research shows that in finance, as with most industries, ambitions and costs have often been larger than returns.

But consistent patterns for success are emerging, like giving staff real-time augmentation with improved knowledge access, better predictive analytics in finance’s complex and competitive market, AI-powered risk management extension and compliance-checking, and customer service assistance, with first contact handling, outreach, and prescreening.

At PTP, we’re proudly AI-first and know that most companies don’t have the resources to invest like these big financial firms. We thrive at helping small, medium, and large firms alike take advantage of these successful use cases with straightforward, effective implementations.

If your company is interested in AI extension through contact handling, outreach, and screening, contact us.

We also have nearly three decades of experience providing top quality tech talent and can help you get the AI professionals you need, onshore, nearshore, or offshore.

While talk of an AI bubble rages and unprecedented resources pour into building out our AI infrastructure, there is no doubt that the technology is here to stay, as evidenced by the deep and expanding AI operations at the some of world’s largest financial service firms.

References

Wall Street banks’ blockbuster quarter gives dealmakers hope for a ‘golden age’ of investment banking, JPMorgan takes AI use to the next level, Business Insider

How AI could power a new age of Big Bank profitability, Yahoo Finance

How finance teams are putting AI to work today and JPMorgan Chase’s Derek Waldron on building an AI-first bank culture, McKinsey & Company

JPMorgan CEO Dimon on AI, Jobs and the Government Shutdown, Bloomberg Podcasts

Here’s JPMorgan Chase’s blueprint to become the world’s first fully AI-powered megabank and Goldman Sachs CEO David Solomon: AI is a longterm secular trend, don’t see it reversing, CNBC

AIG leans on generative AI to speed underwriting and Citi eyes AI productivity gains as it consolidates data systems, CIO Dive

The Hard Road: How AIG Rewired a $50B Dinosaur With AI, Oliver’s Newsletter

Morgan Stanley’s AI Strategy: Analysis of AI Dominance in Financial Services, Klover AI

Goldman Sachs launches AI assistant firmwide, memo shows, Reuters

Capital One: The Ongoing Story Of How One Firm Has Been Pioneering Data, Analytics, & AI Innovation For Over Three Decades, Forbes

How Capital One built production multi-agent AI workflows to power enterprise use cases, Venture Beat

FAQs

How much of AI in finance today is hype vs real results?

While there’s no doubt the big financial firms have won by talking about AI and all it can do for them, these companies have also been major adopters of the technology, both successfully and not. Surveys show that over half of large finance functions use AI in multiple ways, though many splashy pilots have failed to deliver value. Where large, visible value is coming is in back-office automation and customer service, as well as extending the work of coders, and in areas like document analysis, review, and ready access.

What are some of the most common uses for AI among the various financial firms?

While many have implemented ML over the past several years to improve things like document analysis and forecasting, GenAI implementations are commonly helping advisors with data access, auto-drafting financial commentary and managerial reports, checking documents against compliance requirements and monitoring for real-time fraud, improving developer productivity and for code reviews, and in direct customer service contact.

With the big companies investing so much, what role are startups and AI-driven companies playing in the field?

Even with their own splashy pilots and large investments, implementing AI effectively at big banks is a slow process, as evidenced by the ML adoption that’s come over the past five-to-ten years. To this end, keeping up with the pace of change has meant making effective partnerships with companies that have been built around AI from the start. This includes both the major tech companies that are building AI, as well as effective AI startups and companies that craft effective implementation layers for AI.